Written by: Adrian L. Bastianelli, III, Esq., Partner, and Mark R. Berry, Esq., Partner, Peckar & Abramson, P.C.

On March 8, 2018, President Trump signed executive proclamations imposing a 25% tariff on imported steel and a 10% tariff on imported aluminum products under Section 232 of the Trade Expansion Act of 1962. Initial exemptions for Canadian and Mexican products have been announced by the Trump Administration, and the full scope of the tariffs remains subject to trade negotiations. The tariffs will invariably result in increased steel and aluminum prices, which will impact contractors and subcontractors with fixed priced construction contracts. This Bulletin addresses approaches prime contractors and subcontractors may assert to recover under fixed priced contracts for the price increases resulting from the tariffs.

The construction industry has been through historic periods of price escalation in the past, including the oil embargos of the 1970s and the copper and steel spikes in the 2000s economic boom.

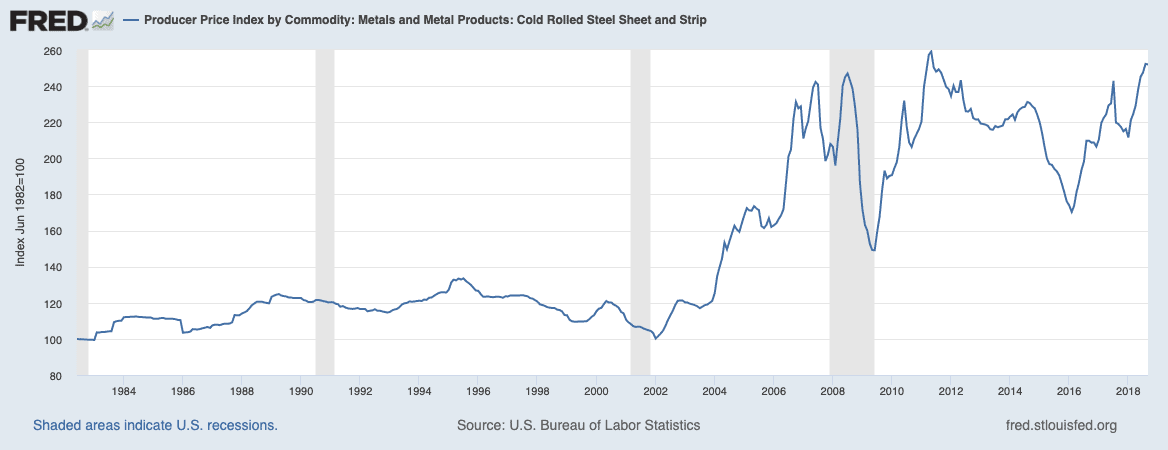

Historical Cold Rolled Steel Pricing

Historical cold rolled steel pricing (St. Louis Fed 1982-Present). Contracts may specify the baseline index by which escalation is measured. If not specified, several common industry and government indices may be used.

During these periods of instability, contractors, who were not protected by price escalation clauses in their contracts, faced difficulty in recovering their increased costs. MCAA’s Management Methods Bulletin, Fixed Price Construction Contracts, Material Price Volatility and Contract Cost Adjustment Clausesii (2010) discusses the most common approaches that contractors may pursue to recover for market-driven price escalation referred to above. The traditional arguments discussed in Bulletin CT 10, however, have not proven successful except in extraordinary circumstances, leaving contractors without adequate relief on existing fixed price contracts. Fortunately, increased material costs typically may be passed through on cost-reimbursement contracts and to a lesser degree on Guaranteed Maximum Price contracts.

While the concepts set out in the 2010 Bulletin can be applied to claims for increases in prices due to the recent steel and aluminum tariffs, there are additional bases that may be used as a means for recovery because of the nature of a tariff. Tariffs are the result of a government decision to require material suppliers to pay increased taxes or duties on imported material, which generally results in an increase in the price of the imported goods above the prevailing market price at the time, rather than a change in market conditions. This distinction may provide additional avenues for cost recovery depending on the contract terms.

Challenges of Traditional Price Escalation Recovery Arguments

Material price escalation is traditionally considered a bargained for risk in fixed price contracting—the contractor bears the risk that costs will increase during the performance of the contract. Thus, standard contract provisions generally provide very limited avenues for relief from price escalation. In any event, the starting point for a claim for price escalation is a close examination of the contract provisions, including flow down provisions which could import favorable cost recovery language from upstream agreements. Some provisions that may form a basis for recovery are discussed below.

Recovery as a Force Majeure Event

Force majeure is an arcane legal principal that nonperformance of a contract is excused for both parties where the events are beyond the control of either party and the risk has not been allocated to one party by the contract. Typically, performance must be made commercially impractical to perform by the unanticipated event in which case both parties to the contract are excused from performance at the agreed schedule or price, or, in rare instances, from any further performance altogether. Force majeure events typically include acts of God, strikes, war or other hostilities, acts of the government or other third parties, and other similar events that are not caused by either party.

Substantial price escalation could constitute a force majeure event, which would excuse both parties from having to perform. In order to prevail, the contractor or subcontractor must demonstrate that the escalation made it impossible or commercially impractical to perform the contract work. If the contractor or subcontractor can get over this high bar, the remedy is not an increase in the price of performance.

Instead, the force majeure event excuses non-performance by both parties. Most contracts and subcontracts today contain a narrow form force majeure clause that limits relief for a force majeure event solely to a time extension. The result of the extension is to excuse the owner from liability to the contractor for delay damages and excuse the contractor from liquidated damages or actual damages to the owner as a result of the delay but provide no additional compensation for the force majeure event— an unsatisfactory remedy for the contractor.

Because the tariffs are unforeseen acts of the federal government, rather than market driven escalation, the risk of which is normally allocated to the prime contractor or subcontractor, they have greater potential to constitute a force majeure event for which the contractor and subcontractor may obtain a time extension or be excused from performance of the contract or subcontract, if the event precludes performance of the work.

Recovery as an Impact of Delay

A contractor may be able to recover for the escalation or the impact of the tariffs under a provision in the contract allowing recovery of delay damages. If an owner caused delay prevented the prime or subcontractor from purchasing materials before the escalation or tariff price increases, the prime or subcontractor is likely to recover these additional costs. A subcontractor similarly may have a right to recover for delay caused by the prime contractor or higher tier subcontractor, provided the appropriate delay and/or changes provisions flow down or are otherwise included in the subcontract.

Recovery Under a Contract Adjustment for Escalation Clause

The parties to a construction contract learned their lesson after the escalation of the early 2000s, and price adjustment clauses for allocating the risk of escalation for certain specified products to the owner began to show up in some contracts. In addition, subcontractors and suppliers began to limit the time period during which their prices were valid.

The ConsensusDocs cost adjustment clause 200.1, Time and Price Impacted Material Amendment 1 (2007, Revised 2011), is a good example of a cost adjustment for escalation clause. Under this provision, the parties establish a baseline price for specifically identified materials potentially subject to time and price impacts. Either party is entitled to an equitable adjustment for an increase or decrease in this baseline price subject to timely notice. The contractor is also entitled to a time extension and compensation for any delay.

The escalation clause should expressly designate the methodology for determining a baseline price. For example, Schedule A of the 200.1 clause recommends that pricing methodology be based on an objective standard comprised of: (1) established market of catalog prices, (2) actual material costs, (3) material costs indices, or (4) such other mutually agreed upon method. Among other indexes, the United Stated Bureau of Labor Statistics publishes producer price indexes for a broad range of commodities in all stages of processing and has published excellent guidance on their use, “How to Use the Producer Price Index for Contract Escalation”[1].

When negotiating the chosen adjustment methodology, the parties also may agree on a range of variability, establishing a minimum price change threshold before entitlement to an adjustment is triggered or a ceiling, which caps the total amount of adjustment. In addition to establishing floors and ceilings for adjustment, the clause may provide specific measures for risk sharing when prices increase, or benefit sharing, when prices decrease.

It is very important when pricing escalation claims based on price indexes, for contractors and subcontractors to correlate the adjustment to the actual price increase or decrease paid. Claiming impact or escalation costs in excess of actual costs incurred raises the potential for false claim violations, even where the pricing conforms to the contract methodology.

While the AIA standard form contracts do not contain a similar provision, Article 3.8.1 of A503, Guide for Supplementary Conditions (2007) recognizes the potential need for such a clause and states:

“…In recent years, unanticipated price escalations in construction materials after the contract is executed have caused concern to owners and contractors. If the owner and architect are concerned about facing such price escalations in certain materials, they should identify those materials prior to the bid and provide for them in the bidding requirements as allowances.”

If such a clause is included in the contract, it will provide the contractor or subcontractor the ability to recover escalation regardless of cause.

Other Contract Provisions

Contractors and subcontractors faced with large escalation claims should review the contract provisions in detail to determine if there are representations or other contract language on which a claim can be made that the contract transferred the risk of escalation to the other party.

Tariff Based Price Increases May Provide Additional Avenues for Recovery

Tariffs may provide a contractor or subcontractor with additional bases for recovering price increases due to the tariffs, because they result from an intentional action of the government for the purpose of increasing the prices of foreign products above the current prices. While sophisticated contractors and subcontractors may be in a position to adequately assess the risk and account for standard market driven price fluctuations, forecasting the possibility and extent of governmental tariffs is beyond the reasonable risk profile for most contractors and subcontractors. As a result, contracts often include contract provisions that provide the contractor or subcontractor with relief from increased prices due to the tariffs.

Change in Law and/or Tax Provisions

A change in law and/or tax provision is found in many industry contract forms, including ConsensusDocs and the AIA documents, as well as the Federal Acquisition Regulation (“FAR”). For example, ConsensusDocs 750, Agreement Between Constructor and Subcontractor (2016) contains the

following change in law provision:

3.27.1 To the extent Constructor receives reimbursement or additional time from the Owner under the prime agreement, the Subcontract Amount or Progress Schedule shall be equitably adjusted for Changes in the Law enacted after the date of this Agreement, including taxes, affecting performance of the Work.

Under this provision, the prime contractor may argue that the subcontractor’s recovery is limited to the prime contractor’s recovery from the owner. The prime contractor probably is obligated to pass though and pursue the subcontractor’s claim, but this requirement may be dependent on other contract terms and the

state law.

Contracts sometimes contain change in tax provisions that might apply to the tariffs. On federal contracts, FAR 52.229-3 broadly permits cost recovery for changes in “federal excise taxes and duties.” AIA A201 § 3.6, General Conditions of the Contract for Construction (2017) allows recovery for changes to “sales, consumer, use or similar tax.” The question of whether the current steel and aluminum tariffs, enacted by executive order, constitute a change of tax remains unresolved.

These change in law and/or tax provisions arguably limit recovery to the amount of the tariff alone, which may not make a contractor whole. For example, tariffs often not only increase the cost of imported goods, but lead to an increase in the price of domestic goods which rise due to the market conditions. This could result in a potentially perverse incentive where a contractor or subcontractor could recover the full tariff increase when purchasing imported steel or aluminum, but have no contractual remedy if purchasing domestic steel and aluminum that may have increased in price because of the market conditions resulting from higher prices for the foreign product. Another cost that may not be recoverable is delay if the contractor or subcontractor elects to avail itself of the lower prices of the domestic product and switch to a new supplier. In addition, the contractor or subcontractor may not be able to recover for equipment or products manufactured with steel and aluminum even thought their price has increased due the tariffs.

Contract Clause for Tariffs

Contractors and subcontractors should include a clause in any quotation they provide that reserves their right to recover for the increased tariff costs similar to the following:

The Price does not include any amounts for changes in taxes, tariffs, or other similar charges that are enacted after the date of this Quotation. Subcontractor shall be entitled to an equitable adjustment in time and money for any costs that it incurs directly or indirectly that arise out of or relate to changes in taxes, tariffs, or similar charges due to such changes including, without limitation, escalation, delay damages, costs to reprocure, costs to change suppliers, costs of manufactured equipment or goods, or other costs of any kind resulting from the changes.

The clause needs to be included or incorporated into the resulting contract or subcontract. If a price is being submitted after the enactment of the tariff, the prices should include the impacts of the tariff.

Recommendations

Review Your Contract

If you incur substantial additional costs as a result of tariffs, review your contract for clauses addressing contract adjustments for escalation, changes in law and/or tax, limits on variability of prices, force majeure, delay damages, or any other provision that might support an argument that the risk of increased costs of the tariffs has been transferred to the other party. The contract governs your ability to recover these additional costs. Unless you have a contract provision that clearly provides for recovery, your claim should focus on the uniqueness of the tariffs.

Proactively Include Cost Adjustment for Escalation Clauses and Change in Law and/or Tax Provisions in Your Contract

The lessons learned from past price escalations should be applied to tariffs, and you should include clauses in your contract or subcontract to protect yourself in the future. The starting point is a cost adjustment for escalation clause that specifically provides you the right to recover, if the cost of certain products escalates for any reason. This clause should be broad enough to allow for the recovery of other costs, such as delay damages or escalation in the cost of equipment or products containing the material. A change in law and/or taxes should also be included.

*This article was originally by MCAA, a ConsensusDocs Coalition member, in their Management Methods Manual.